Nick and Katie's Travel Blog!

-

Day 15: Badlands of New Mexico

-

Day 14: Grand Canyon and the City of Broken Dreams

-

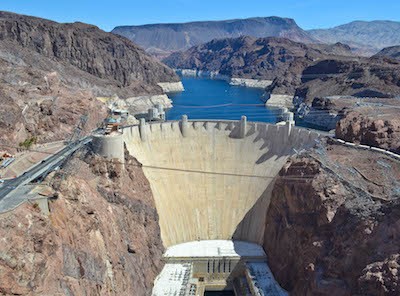

Day 13: Hoover Dam and an attempt at camping

-

Day 12: Las Vegas

-

Day 11: San Diego Zoo & Joshua Trees

-

Day 10: We arrive at the border with Mexico

-

Day 9: LA - Beaches and Traffic

-

Days 7 and 8: Windy Path to the City of Angels

-

Days 5 and 6: Golden State to Golden Gate

-

Day 4: Trees, Rain, and Humboldt Fog - Welcome to California

-

Day 3: Sea Lions and Rocks

-

Day 2: Oregon Coast!

-

Day 1: Leaving Washington!

-

More plans for Austin!

-

Snow Apocalypse!

-

Planning the Trip!